How to do more with your money

Four tips to help you grow your assets steadily and reliably.

navigation

Migros Bank

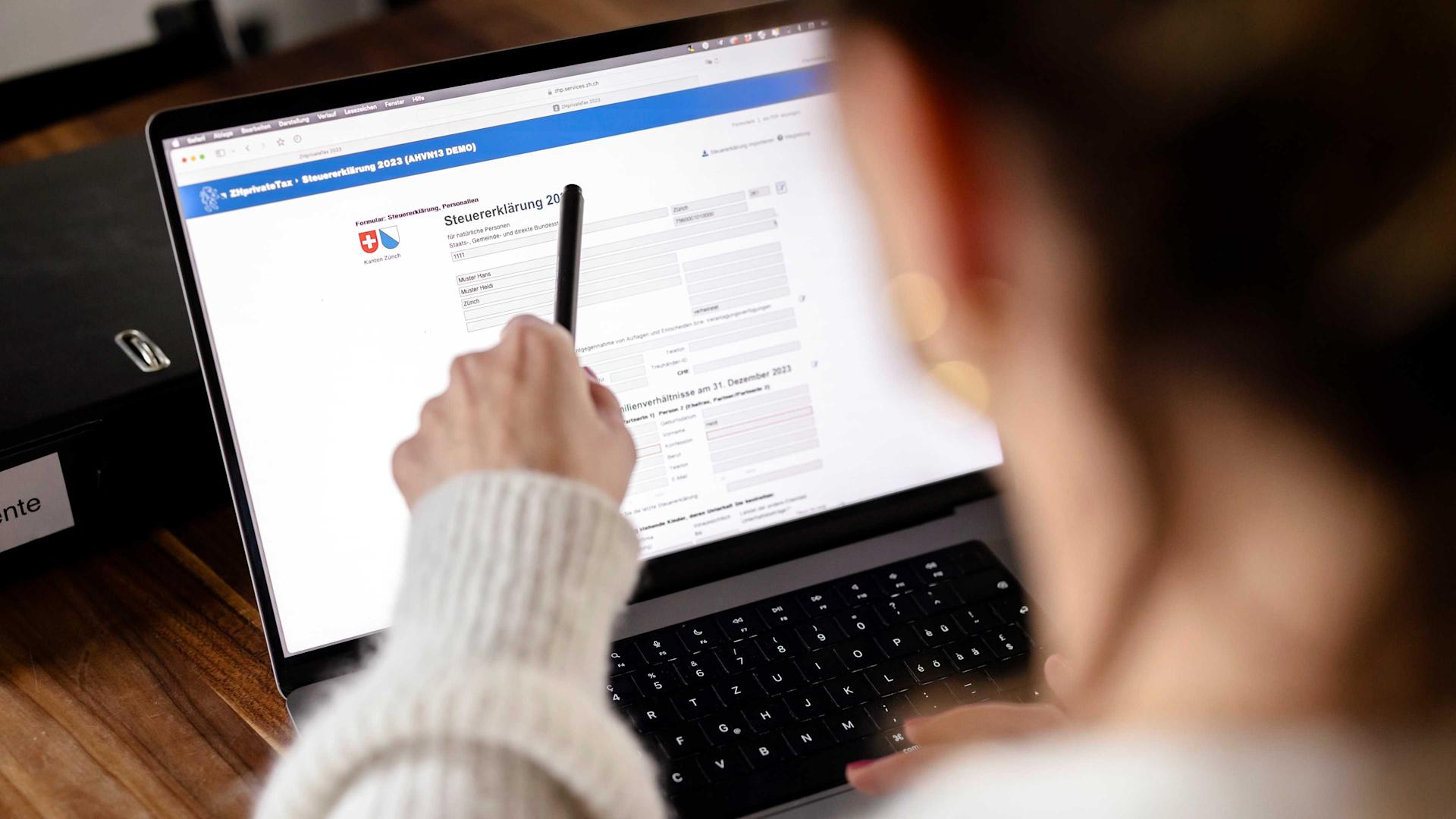

Many people put off filing their tax return. These hacks on how to save money when completing the form are a motivation booster.

There are many ways to reduce your tax burden. It's all about deducting expenses and reducing taxable income. Here are the key pointers.

Employees can deduct professional expenses from their tax. These include costs for commuting to work or for work clothing, such as safety shoes, but not representative clothing such as suits. Training and development costs are tax-deductible too. A flat-rate deduction can also be claimed for meals at the place of work.

Anyone who pays mortgage interest on residential property or interest on private debt can declare this in their tax return. The same goes for interest on consumer loans, for example to buy a car.

People in employment can deduct payments into the pillar 3a from their taxable income. It's best to pay in the maximum amount for the current tax period if you can afford to. This enables you to take full advantage of the tax benefits. In 2024, the maximum limit for employees with a pension fund will be CHF 7,056.

The purchase of additional pension fund benefits are also deductible. The maximum level of benefits that can be purchased is indicated on the pension fund statement under 'Further information'. If you have a significant pension shortfall, it's best to spread the purchases over several tax periods to benefit from the maximum tax deduction each time. You should consult a financial expert before purchasing additional benefits.

In addition to premiums for health and accident insurance, health expenses can also be deducted if they are not covered by health insurance – such as visits to the dentist or a new pair of glasses. Please note: most cantons require such expenses to make up at least five percent of net income (net income less deductions).

There are also tax optimisation options in relation to recurring asset management fees. For example, custody and bank account fees can be deducted, as can fees for a safe deposit box and preparation of tax statements.

Homeowners can benefit from investing in energy-saving measures, such as the installation of solar panels or energy-efficient windows. Maintenance and renovation work (kitchen, bathrooms, floors, roof) is also tax-deductible.

Sven Illi is a customer advisor at Migros Bank.

Whether you’re interested in science, sustainability, health or saving money – our team of experts is on hand with practical tips and tricks.