Migros Bank

How to do more with your money

Four tips to help you grow your assets steadily and reliably.

navigation

Migros Bank

Five key factors determine whether it's better to opt for a lifelong annuity pension, a one-off lump-sum payment or a combination of the two.

Pension fund assets are one of the main pillars of retirement provision. How you draw them - whether as an annuity pension, a lump-sum payment or combination of the two - is an irreversible one-off decision. This should therefore be considered and planned carefully, ideally with the support of professional financial advisers.

If you'd prefer to receive a pension, you needn't do anything. However, withdrawing a lump sum may require notification up to three years in advance. Policyholders should check the notification period with their pension fund provider in good time.

The best withdrawal option depends on the following factors:

In the case of lifelong annuity pensions, the pension fund is responsible for managing the retirement assets. It invests the money to achieve stable returns. It only assumes minor risks. However, the pension fund must pay pension benefits to policyholders for life – even if the money saved in the pension fund has actually been used up.

If the lump-sum withdrawal option is exercised, this responsibility passes to the policyholder, who must then make sure that the money doesn't run out too soon. At the same time, he or she can invest it as they wish for a chance to generate higher returns. However, there is a risk of incurring losses if the market conditions prove unfavourable.

Annuity pensions provide predictability and security because a fixed monthly amount is paid. However, policyholders have no influence over the pension fund's investment decisions.

Lump-sum withdrawal provides financial flexibility: in addition to investment, the assets can also be used to pay off a mortgage or make inheritance advances, for example.

The people sharing the policyholder's household also benefit from a lifelong annuity pension. After the policyholder's death, their spouse usually receives a survivor's pension (often 60% of the pension), while children usually get 20% if they are under 18 or still in education.

Under the lump-sum withdrawal option, the spouse is not automatically secured financially. The unused capital flows into the deceased policyholder's estate and can then be bequeathed. Provided there are no financial liabilities to settle, the assets may be bequeathed to siblings, friends or organisations, for example, after the policyholder's death.

In the case of annuity pensions, any remaining capital stays in the pension fund when the policyholder dies.

The level of pension benefits is fixed and based on how much is paid in and the conversion rate applied by the pension fund. The revenues steadily lose value because they aren't automatically adjusted for inflation.

Opting for a lump sum payment enables policyholders to define the withdrawn amount individually. Investing the capital also gives them an opportunity to generate returns above the rate of inflation.

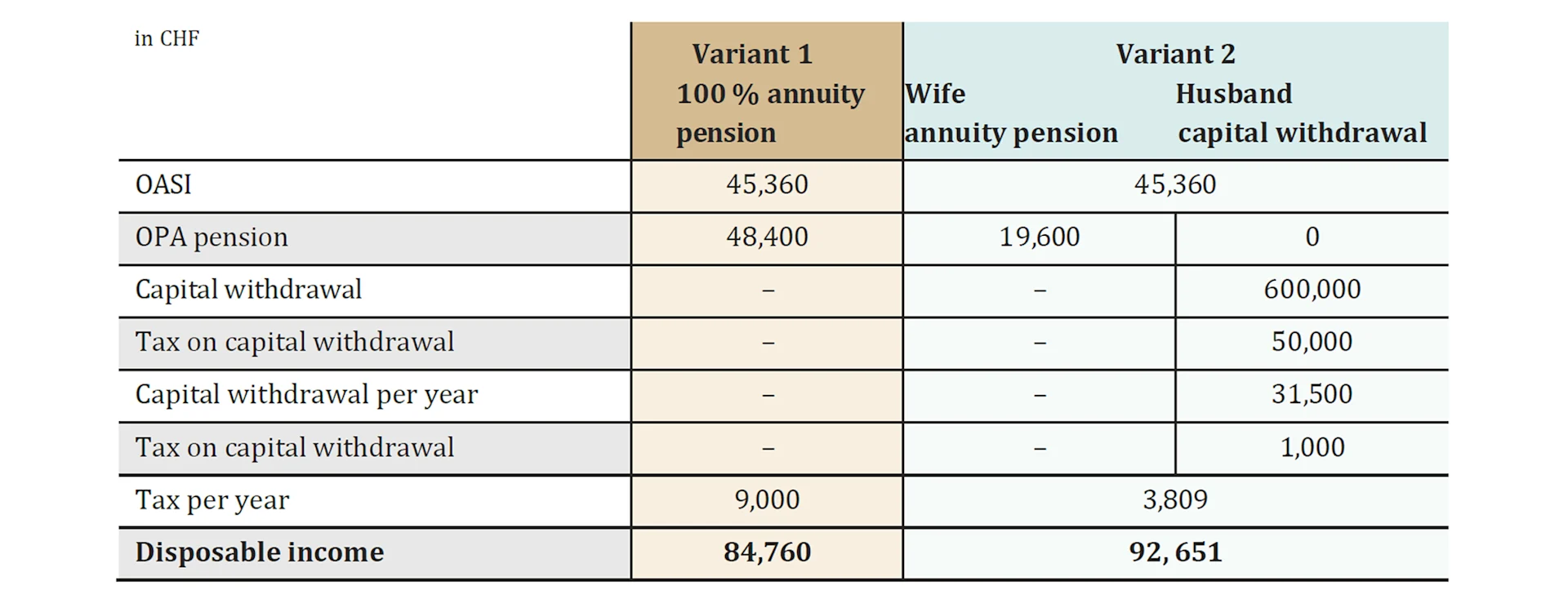

The entire pension is liable for income tax every year. However, lump-sum withdrawals are subject to a reduced, one-off tax paid separately from other income.

From a purely fiscal perspective, lump-sum withdrawals are mostly more attractive. However, the other four factors should also be taken into consideration when deciding between an annuity pension and lump-sum withdrawal.

Married couple, residing in Aarau, non-denominational

Discover exciting stories about all aspects of Migros, our commitment and the people behind it. We also provide practical advice for everyday life.